Do you often hear someone say “l(fā)aser”?customs clearanceBe assured, this time is not to tell you a sad story, but a successful case! want to know how to easily toll your laser at Shanghai Airport? follow our steps.

A. Success case background

Among the many laser importers, one customer, after comparison and in-depth communication with several companies, decided to choose us to assist him in completing the laser import work at Shanghai Airport. Our business commissioner, specialized in mechanical equipment and instrument customs, developed detailed import schemes for customers, effectively bypassing many potential problems.

Detailed information about Shanghai airport

First, let’s clarify some basic information about this laser:

HS code: 9013200099

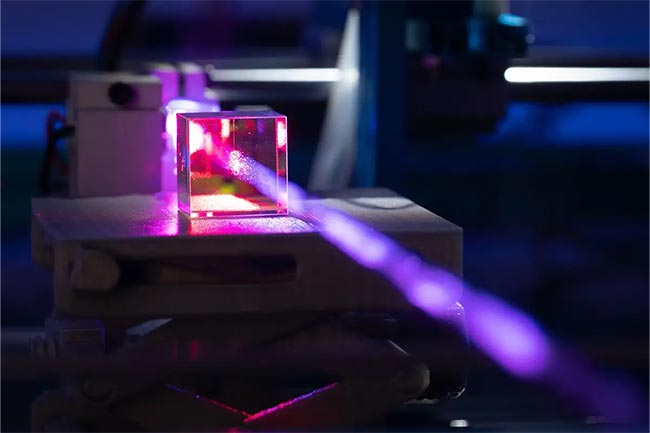

Product Name: Other Laser

Product description: Except for laser diodes

? Marking code and notes: Repair items, forward repair, paid repair, repair protocol number: FMY-R20220901, the expected return date for departure is before April 25, 2023.

? Tax information:

Value Added Tax Rate: 13%

The most favoured tax rate: 0%

? Temporary import tax rate:

? Common import tax rate: 11%

The consumption tax rate:

In addition, the declaration elements of the imported laser include: brand type, export benefits, use, principle, brand, model, etc. It is worth noting that the regulatory conditions for the import are no, and the inspection and vaccination category is also no.

Third,Import agentThe entire customs process.

Importing a laser may sound complicated, but as long as you follow the right process, everything becomes simple:

Signing of Import Contracts:Ensure agreement with foreign suppliers.

and maritime transportation:Choose the appropriate mode of shipping and transport the laser to the domestic terminal.

3 Notification of Arrival:Upon arrival of the goods, the ship company will issue a notification of arrival.

4 and change:Keep a delivery notice to the ship company in exchange for a pickup note.

5 Testing of vaccines:According to the regulatory conditions of the product, the necessary inspection and vaccination are carried out.

The Customs Report:Submit the necessary customs documents.

Customs Pricing:Customs will review the declared prices.

8 of taxes:Tariffs and value added tax are paid according to the tax list.

9 and Delivery:Take the cargo cabin from the port.

Customs and Release:After the above steps, the goods will be smoothly customs and released.

11 and transportation:Transport the goods safely to the designated locations in the country.

Follow customer service WeChat

Follow customer service WeChat