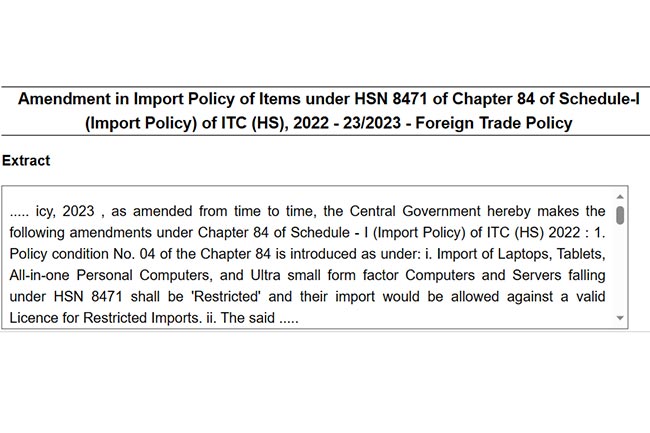

The General Office of Foreign Trade of India (DGFT) has recently issued new rules for the import of HSN 8471 products, namely laptops, tablets, computers and servers.

1 from1 November 2023Import of the above products requires application and obtaining an import license.

2, but belowIn particular circumstances, this can be exempted.The Request:

(a) The quantity purchased through an e-commerce platform is one laptop, tablet, computer or ultra-small computer, which, if sent by post or express mail, may not require a license, but may be subject to normal customs duties.

(b) In the absence of a license, a maximum of 20 such products may be imported per batch, which are limited to non-commercial uses such as R&D, testing, repair, and must be destroyed or re-exported after use.

(c) If the products are repairs sent from abroad, no additional licenses are required for import.

(d) Products exclusively intended for local production in India, and no import license application is required.

In order to ensure compliance, importers should carefully read and follow the new regulations, while closely monitoring any subsequent updates or revisions.

The original address:Amendment in Import Policy of Items under HSN 8471 of Chapter 84 of Schedule-I (Import Policy) of ITC (HS), 2022 - 23/2023 - Foreign Trade Policy (taxmanagementindia.com)

Follow customer service WeChat

Follow customer service WeChat